How FIs overcome the challenge of personalizing client communications

May 2, 2023

Content from Globe Content Studio

The financial sector is one of the most technologically advanced in Canada, yet financial institutions (FIs) often struggle to simplify the complexity of client communications. These programs require personalization across different lines of business and regions, as well as tight compliance in a rigorous and evolving regulatory environment.

To gain the technical backbone to meet these complex challenges, many of Canada’s largest banks, insurers, mortgage brokers, and investment advisors turn to DCM (Data Communications Management).

“There has been a shift in the marketing landscape for FIs, with smaller teams and reduced budgets,” says Shelly Anwyll, senior vice-president for North America at DCM. “All the while, there are significantly more touch points that need to be minded. The opportunity to scale and become very efficient with those resources is something every FI is looking for, especially as more clients engage through multiple media.”

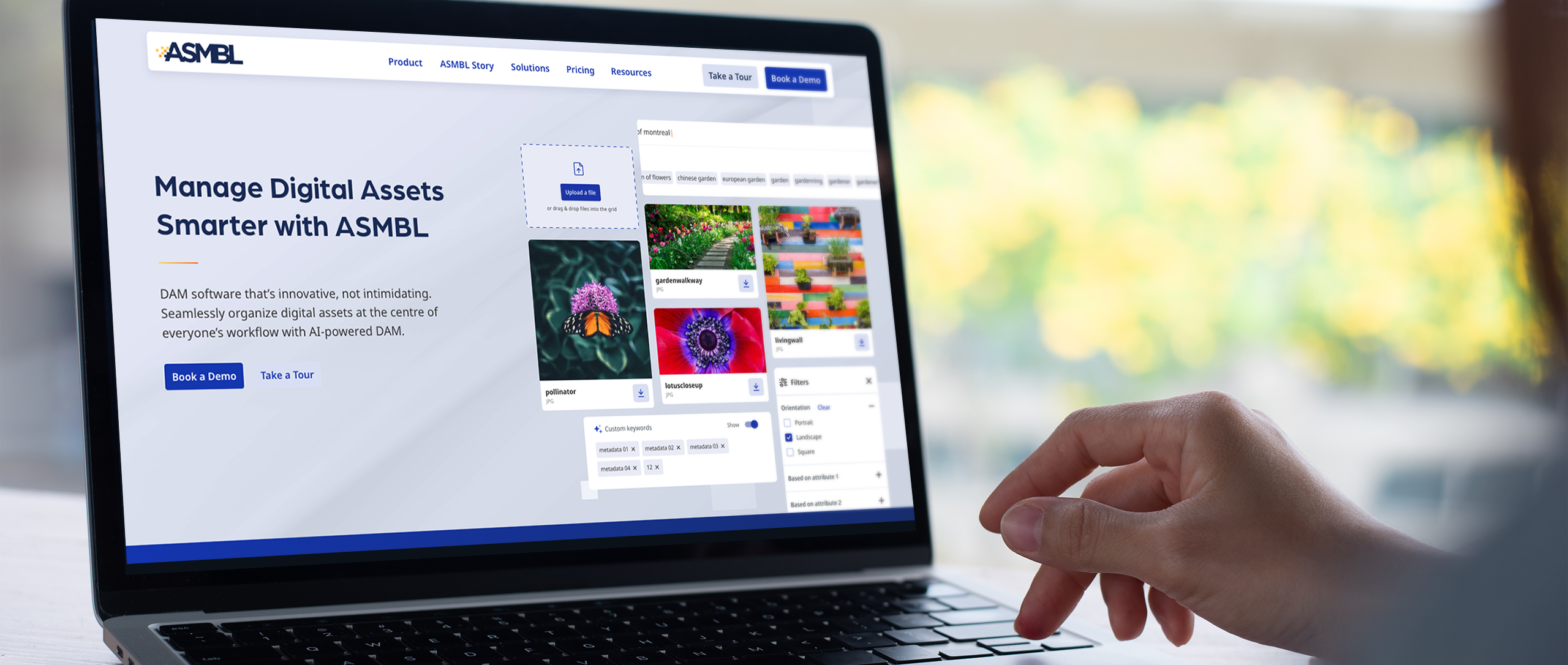

DCM’s strong reputation with financial clients comes from decades of providing them with marketing and business communication solutions. Among them is DCMFlexTM, a market-leading workflow management platform. The solution helps reduce costs and compliance headaches by streamlining content design, centralizing marketing assets, and allowing for personalization on a large scale.

Istockphoto / Getty Images

|

“DCMFlex enables FI teams, from marketing coordinators to client-facing advisors, to develop personalized content on-demand,” says Jim Ferreira, senior vice-president of enterprise solutions at DCM. |

Consider an investment advisor who needs to print portfolio information for in-person client meetings, or produce digital documents to email securely.

“You could have a universe of hundreds of investment products, and need documentation for 15 of those for a meeting,” Mr. Ferreira explains. “DCM can construct all these documents in a compliant manner, so that advisors can do what they do best: advise their clients.”

Platform slashes time and costs

DCMFlex serves the needs of more than 500 companies, handling thousands of marketing and communications transactions daily. The platform helps automate workflows, while updating templates regularly to adapt to regulatory, corporate governance, and branding changes. For example, the platform can automatically apply daily changes in interest rates where needed.

“The templates allow us to lock in core content, as well as version control for different clients for various compliance requirements,” Ms. Anwyll says.

Throughout the workflow, there are built-in fail-safes, such as approver sign-offs before content is released. This helps reduce errors and overlap, cutting costs for some clients by nearly 90 per cent – “and all in a seamless, worry-free manner,” says Ms. Anwyll.

Beyond costs, DCMFlex also saves significant time, helping FI marketers and advisors stay competitive. Existing processes often require lead times of at least three days to approve marketing and communication materials – that doesn’t include design and potential print time. “Now, what took days can be done in two to three minutes,” Mr. Ferreira says.

Istockphoto / Getty Images

Before adopting DCMFlex, one FI was using multiple platforms to execute marketing campaigns. Each campaign took weeks to build. The system required extensive manual intervention and was expensive to maintain. With DCMFlex, six lines of business have automated these processes, enabling them to access marketing content through a single interface.

DCMFlex can be up and running in just a few months. “It’s designed for quick adoption, and is able to seamlessly integrate with other marketing technology such as CRM platforms and internal systems,” Ms. Anwyll says.

For FIs using it, DCMFlex has become an integral tool in their marketing ecosystem. It’s a way for marketers and client-facing teams alike to improve client relationships, execute omnichannel strategies more efficiently and improve customization, whether it’s one-to-one personalization or targeting local markets with more relevant content.

“Personalization is so important in the financial industry, with clients and prospects wanting information in real time, in their preferred format,” Ms. Anwyll says. “DCMFlex not only makes that possible, but does so in a way that’s surprisingly simple, too.”

Advertising feature produced by Globe Content Studio with DCM. The Globe’s editiorial department was not involved.

|

Want to learn more about how DCM supports Canada’s largest financial institutions?Explore our Financial Services

|